12-YEAR ANNIVERSARY FOR GAPLESS INDICATORS! THANK YOU ALL!

Introducing Gapless Technical Indicators for Professional Traders!

Never worry again how opening price jump or drop affects your favorite classic indicator (MACD, Stochastics, EMA, etc) and for how many bars. Gapless Indicators are enhanced versions of 15 classic technical indicators (complete list below) that self-adjust in real-time to any opening gap (aka overnight gap), while being completely repainting-free. No additional market data downloads, setups, or configurations required. Simply start using gapless ones instead of the classic ones and enjoy the benefits. Gapless Indicators can be used for discretionary trading as well as in automated strategies, backtesting, optimization, and walk-forward.

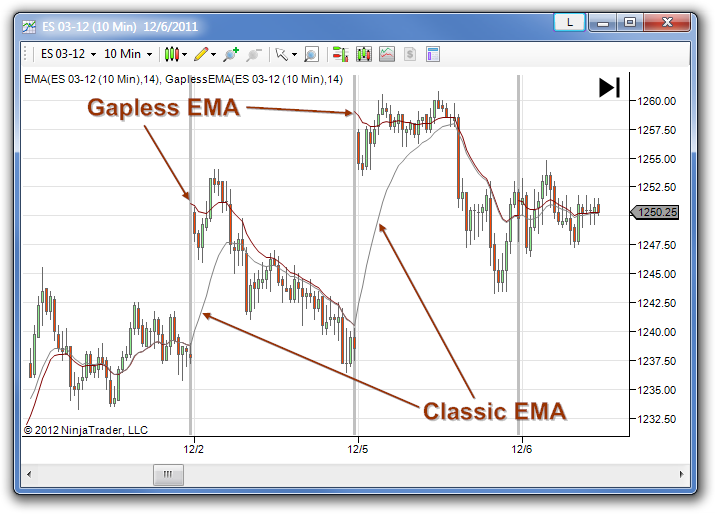

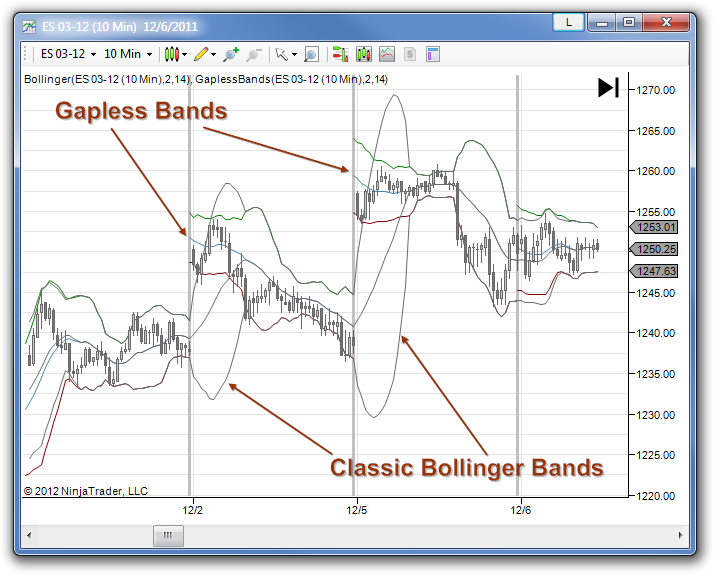

Quick visual comparison - Gapless versus Classic:

Complete List (15 in total):

- Gapless Stochastics

- Gapless MACD

- Gapless Bands

- Gapless RSI

- Gapless CCI

- Gapless ADX

- Gapless DI

- Gapless ATR

- Gapless Parabolic SAR

- Gapless Support Resistance

- Gapless EMA

- Gapless SMA

- Gapless WMA

- Gapless HMA

- Gapless Linear Regression

Benefits of Gapless Indicators:

- See more and sooner than other market participants that use classic (non-gapless) versions!

- Proprietary gapless algorithms, not published anywhere, at your service

- Peace of mind regarding opening price gaps - Gapless Indicators take care of that automatically in real-time!

- Gap affects indicators for at least 12-24 price bars afterwards - Gapless Indicators do not have that problem!

- More precise and more accurate compared to their classic counterparts

- No additional data downloads needed

- Compact and lightweight on cpu and memory

- Drop-in replacement - Gapless Indicators have the exact same inputs as classic versions, so no learning curve!

- Gapless Indicators can be used for both discretionary and automated trading styles!

- Can be utilized in semi-automated and fully automated trading strategies and trading systems

- Can be used for optimization, backtesting, walk-forward, genetic algorithms, quantitative analysis, etc

- Allow better quality input datasets for statistical analysis, data science, machine learning, data mining, predictive analytics, algorithmic modeling, artificial intelligence, etc.

- Cloud friendly ( Microsoft Azure, Amazon AWS )

- VPS friendly ( Virtual Private Server )

- Many more ... download and see in action first hand!

Some examples of Gapless Indicators in action:

- Any timeframe

- Tick

- Volume

- Range

- Renko

- Stocks/Equities

- Futures

- Forex (FX)

- Indices

- ETFs

- Options (Calls/Puts)

- Bonds

- NinjaTrader 8 (NT8)

- NinjaTrader 7 (NT7)

- Windows 10, 8, 7, Vista, XP

- Windows Server 2019, 2016, 2012, 2008, 2003

- 64-bit (x64) & 32-bit (x86)

See it for yourself, download FREE TRIAL/EVALUATION VERSIONS!

No setups to run - just download and import into NinjaTrader 7/8 and you're ready to go.

Please let us know your opinions or questions. Thank you for visiting.

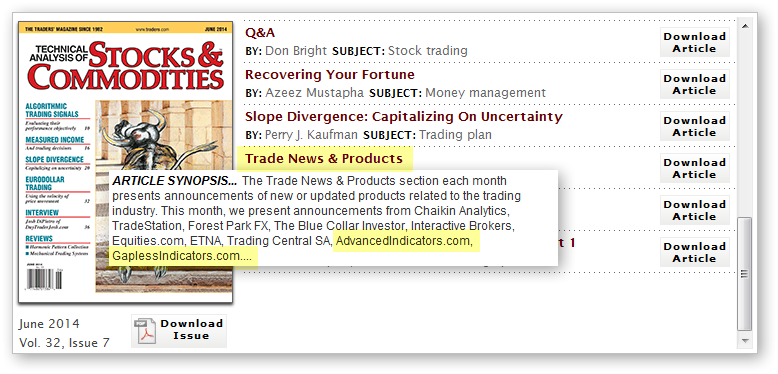

ALSO: Featured in Technical Analysis of Stocks & Commodities Magazine!( TASC June 2014 Issue - Trade News & Products section )

FULL RISK DISCLOSURE: Trading in financial markets contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

COOKIES: This site uses cookies for visitor analytics. By continuing to browse this site, you agree to this use.